Services

Probate & Intestacy

Experienced Inheritance Solicitors based in the heart of Bradford, Bingley and Yeadon.

Request A Callback

Probate & Intestacy

How Eatons can support you

On the death of a loved one, the first step is to establish if there is a Will and who are the named executors. If there is a Will, the process is simpler, as we know who has been appointed to deal with the estate and exactly how the estate is to be distributed. Our specialist team can advise and assist at this difficult time.

Contact Eatons Probate Solicitors Today

Dealing with the administration of an estate is a complicated area that can be intimidating to those who are unfamiliar with them. Trust our experienced probate and intestacy solicitors at Eatons and Contact Us today. We also provide other legal services such as wills and inheritance because we understand how difficult this matter can be.

Some of our FAQ's

Click below to see some of our FAQs, providing the answers to help you understand our services better. Still can't find what you're looking for? Please don't hesitate to reach out to us directly.

Why is it important to make a Will?

If you make a Will, you can specify exactly who inherits your estate and in what proportions. You can list gifts that you would like to leave to family, friends and charities, and if you are including legacies to children, you can set out the age they should inherit.

You can also name executors who will administer your estate and carry out the terms of your Will. These can be family members, friends or professionals. If you do not have a Will, the person dealing with your estate may not be the person you would have necessarily chosen, nor the one who is most able and trustworthy.

If you have children who are minors, you can name guardians. The guardians don’t have to be family members, and quite often people prefer to appoint friends, as they may be more local and the children may have a closer bond with them. Friends may not be considered if they are not named in a Will.

Who inherits if there is no Will?

If there is no Will, then the deceased is deemed to have died intestate. This means that the law decides who inherits the estate under the rules of intestacy and who can deal with the administration of the estate. Only a spouse or civil partner and other close members of the family would inherit. We can assist you in working through the deceased's family tree to ensure the correct relatives receive the funds.

Couples who are not married but are living together, would not be entitled to a share of the estate under intestacy rules.

If someone is separated from their spouse or civil partner but not divorced or civil partnership has not legally ended, they would still be entitled to inherit under the rules of intestacy.

What happens when someone dies?

On the death of a loved one, the first step is to establish if there is a Will and who are the named executors. If there is a Will, the process is simpler, as we know who has been appointed to deal with the estate and exactly how the estate is to be distributed. Depending upon the size and complexity of the estate, the executors may need to take out a Grant of Probate. This is a legal document, which gives the executors authority to deal with the assets and carry out the wishes contained in the Will.

If there is no Will, then we would need to establish who is entitled to benefit under the rules of intestacy. It is quite often those people who are entitled to administer the estate. They would need to apply for a Grant of Letters of Administration, which is equivalent to a Grant of Probate if there was a Will. This can often lead to disputes within the family as sometimes there may be more than one person entitled to take out the Grant, and there does not have to be agreement within the family as to who that person should be.

How do I know what probate and intestacy process I need to follow?

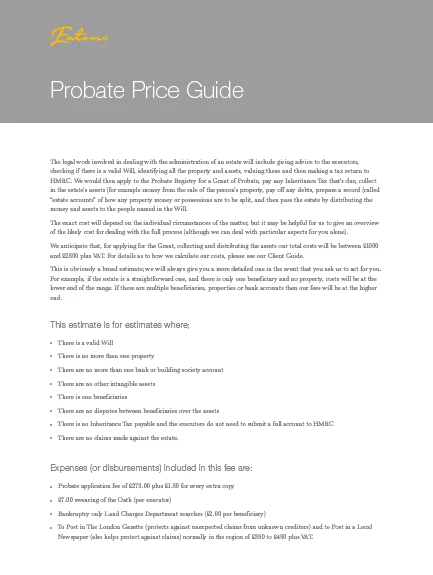

Our team of probate solicitors will support and guide you through the probate and intestacy process. We know experiencing the death of a loved one is never easy, and Eatons are right by your side when it comes to sorting out assets and belongings for someone that has died. We can help you with managing the legal aspects of the entire process.

We can advise whether a Grant is required or not, and if one is needed, what the procedure is. We will also assess whether there is inheritance tax to pay, and if so, we are happy to deal with HMRC.

We can collect in all the assets, advertise for creditors, pay outstanding debts, trace assets and beneficiaries (if needed), prepare accounts and pay out all the beneficiaries.

We can help if circumstances become difficult…

Some probate can become more complicated at times when disputes arise between the executor, beneficiaries, creditors, or HMRC, therefore we work closely with the dispute resolution team to ensure the advice given is accurate and legalities are covered.

At Eatons, our trusted solicitors can support you throughout any stage of the probate and intestacy process.

Probate and Intestacy Solicitors Yorkshire

We have been operating as a professional leading law firm for over 150 years, providing legal advice to a diverse range of clients. We provide our services throughout West Yorkshire and have offices in Bradford, Yeadon, and Bingley. Visit one of our locations today. We are here to assist you in handling cases for bereavement or many other legal services.

Providing you with a quality service, we ensure that your case is our focus and our Yorkshire roots mean we aim to be friendly and trustworthy at each touchpoint

Trusted & Friendly

Well Established

Quality Service

Customer Focused

Yorkshired Based

Whether you're a business, family, or individual, Eatons has a range of services which can help you.

For You

For You

For You

For You

For You

For You

For You

For You

For You

For You

For You

For You

For You